NEWS

LATEST NEWS IN THE MINING INDUSTRY

LATEST NEWS IN THE MINING INDUSTRY

Royal Bafokeng Platinum (RBPlat) CEO, Steve Phiri, has joined the growing number who believe primary platinum production from South Africa will be cut, a development that would contribute towards widening the supply deficit. “Well, if it is not planned, it is forced on us,” said Phiri of production cuts. “Circumstances force us into that direction. You cannot just produce for the sake of volumes,” he said.

*Note you will be redirected to an

external website.

GOLD Fields claimed to have achieved “a key milestone” in its balance sheet management, announcing today it had refinanced $1.44bn in credit so that it doesn’t have to repay the first tranche of the debt until 2019. “The refinancing is a key milestone in Gold Fields’ balance sheet management and increases the maturity of its debt, with the first maturity now only in June 2019 (previously November 2017),” it said.

*Note you will be redirected to an

external website.

THARISA is to list on the London Stock Exchange in an effort to boost trading in the share which has a free-float of 25% on the Johannesburg Stock Exchange where it will remain primarily listed. Michael Jones, CFO of the R2bn chrome and platinum group metal (PGM) producer, said today that UK and European institutional investors had shown interest in owning the share following a roadshow.

*Note you will be redirected to an

external website.

With gold the only commodity seemingly immune to the perils of a price decline, miners are keen to share ideas on how to survive the storm. Junior miners, possibly feeling the most pressure, had a rare opportunity to get advice from experienced industry players on how to survive the downturn at the Junior Indaba, held at the Johannesburg Country Club, on Wednesday.

*Note you will be redirected to an

external website.

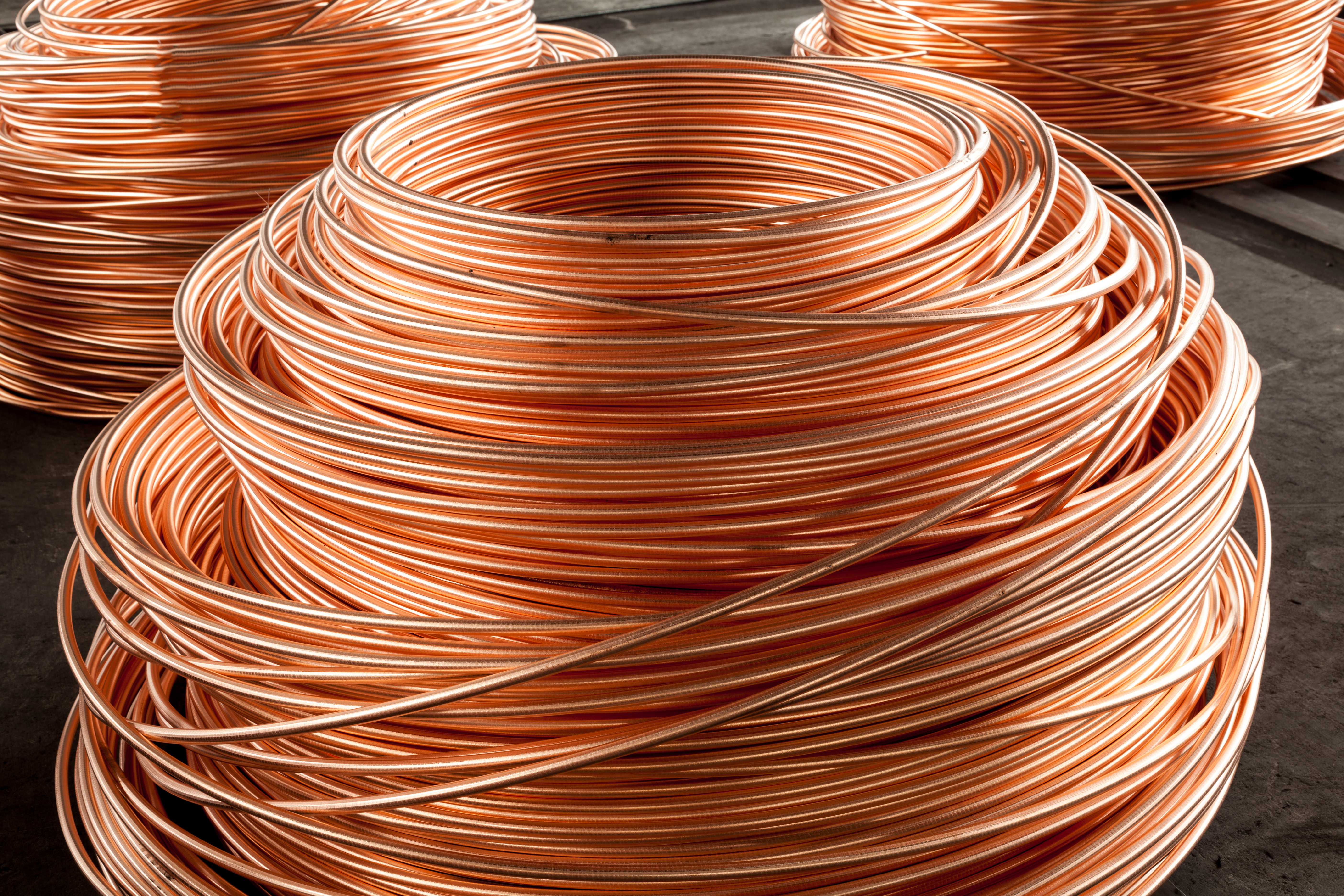

Copper futures headed for the biggest gain in six sessions as economic indicators in the U.S. and China boosted demand prospects, while a weaker dollar made commodities cheaper in other currencies. In China, industrial companies’ profits climbed 4.8 percent from a year earlier, snapping a seven-month losing streak in the first weeks of this year, government data show. In the U.S., the second-largest copper user, contract signings for home sales climbed 3.5 percent in February, beating the median estimate of 1.2 percent in a Bloomberg survey of economists. The Copper Development Association in New York estimates construction accounts for about 40 percent of the metal’s use.

*Note you will be redirected to an

external website.

© Copyright 2016, Borwa Mining Instruments